- Net Subscriber Additions of Over 100,000 - Pro Forma Total

Revenue of $630 Million, Up 3% - Pro Forma Adjusted Income from

Operations of $106 Million - An Improvement of $143 Million

Year-Over-Year - EPS, Excluding Charges, ($0.00) vs. ($0.05)

Year-Over-Year - Company Affirms Full-Year 2009 Guidance and Issues

New 2010 Guidance NEW YORK, Nov. 5 /PRNewswire-FirstCall/ -- SIRIUS

XM Radio (NASDAQ:SIRI) today announced third quarter 2009 financial

and operating results, including $106 million in pro forma adjusted

income from operations, marking the company's fourth consecutive

quarter of positive pro forma adjusted income from operations. The

company also announced a 19% decrease in pro forma total cash

operating expenses compared to the same quarter last year. (Logo:

http://www.newscom.com/cgi-bin/prnh/20080819/NYTU044LOGO ) "We are

very pleased with what we accomplished during the third quarter,

especially when considering the macroeconomic issues affecting

consumers and the auto industry," said Mel Karmazin, SIRIUS XM's

CEO. "We managed to grow revenue, grow ARPU, reduce operating

costs, increase adjusted income from operations significantly, and

refinance higher cost debt. We look forward to continuing this

performance. We grew subscribers and improved churn in the quarter,

and we are well positioned to take advantage of an economic

rebound. We expect to grow subscribers, revenue, and cash flow next

year regardless of the magnitude of any recovery." Third quarter

2009 pro forma total revenue was $630 million, up 3% from third

quarter 2008 pro forma total revenue of $613 million. Third quarter

2009 pro forma subscription revenue was $587 million, up 3% from

the third quarter 2008 pro forma subscription revenue of $572

million. Pro forma amounts exclude the effects of stock-based

compensation, purchase accounting adjustments, and assume the

merger of SIRIUS and XM occurred on January 1, 2008. Monthly

average revenue per subscriber (ARPU) was $10.87 in the third

quarter 2009, up 3% from $10.51 in the third quarter 2008. SIRIUS

XM ended the third quarter 2009 with 18,515,730 total subscribers,

a decrease of 2% from the third quarter 2008 pro forma total

subscribers of 18,920,911 and an increase of 102,295 from the

second quarter 2009 subscribers of 18,413,435. Self-pay subscribers

were 15,456,748, up 266,160 from the 15,190,588 self-pay

subscribers in the third quarter 2008 and up 35,405 from the second

quarter 2009. The self-pay monthly customer churn rate was 2.0% in

the third quarter 2009, in-line with the second quarter 2009, and

up from a pro forma 1.7% churn rate in the third quarter 2008.

Ending promotional subscribers were 3,058,982 in the third quarter

2009. In the third quarter 2009, SIRIUS XM achieved positive pro

forma adjusted income from operations of $106 million as compared

to a pro forma adjusted loss from operations of ($37) million in

the third quarter 2008. The third quarter 2009 US GAAP net loss was

($149) million, or ($0.04) per share, and included $138 million, or

($0.04) per share, in net charges for the loss on the

extinguishment of debt and credit facilities resulting from

refinancing of debt at lower cost. Absent these charges, the US

GAAP net loss per share was ($0.00). Third quarter 2009 free cash

flow was $27 million compared to ($98) million of pro forma free

cash flow in the third quarter 2008. 2009 AND 2010 OUTLOOK SIRIUS

XM affirmed its year 2009 guidance of over $400 million in pro

forma full-year adjusted income from operations. The company also

provided guidance for 2010. "We expect the company's cash flow

growth momentum to continue into 2010, and we project full-year

adjusted income from operations to increase approximately 20% next

year," said Mr. Karmazin. Based upon assumed 2010 automobile sales

of 11.3 million units, SIRIUS XM expects to achieve positive

full-year subscriber growth in 2010. The company also expects 2010

revenue growth of mid- to high-single digits, and growth in free

cash flow compared to 2009. "While the near future's macroeconomic

performance is extremely difficult to predict, our business has

reached sufficient scale to allow us to continue to grow cash

flow," Mr. Karmazin added. BALANCE SHEET IMPROVEMENTS As previously

reported, the company took advantage of strong credit markets

during the third quarter by selling $257 million of new 9.75%

Senior Secured Notes due 2015 in order to repay $250 million of 15%

term loans that would have matured in 2011 and 2012. "By

refinancing at more favorable rates and extending maturities,"

noted David Frear, Executive Vice President and Chief Financial

Officer, "the company has dramatically improved its near-term

liquidity and doesn't face any material debt maturities until 2011.

The two financing transactions completed in the second and third

quarters have reset the company's capital structure, allowing us to

execute our business plan without balance sheet constraints." The

company also reported that, in addition to the previously announced

repurchase of $179 million of XM Holdings' 10% notes due in

December 2009, it repurchased nearly $59 million of XM Holdings'

10% Senior PIK Secured Notes due 2011. "These debt repurchases

demonstrate management's commitment to optimize the company's

capital structure on an opportunistic basis," added Mr. Frear.

Based upon the company's current plans, it has sufficient cash,

cash equivalents, and marketable securities to cover its estimated

funding needs through cash flow breakeven, the point at which

revenues are sufficient to fund expected operating expenses,

capital expenditures, working capital requirements, interest

payments and taxes. The company's projections are based on

assumptions, which it believes are reasonable but contain

uncertainties. PRO FORMA RESULTS OF OPERATIONS The discussion of

operating results excludes the effects of stock-based compensation,

purchase accounting adjustments, and assumes the merger of SIRIUS

and XM occurred on January 1, 2008. All results discussed below are

pro forma unless otherwise noted. THIRD QUARTER 2009 VERSUS THIRD

QUARTER 2008 For the third quarter of 2009, SIRIUS XM recognized

total revenue of $630 million compared to $613 million for the

third quarter 2008. This 3%, or $17 million, increase in revenue

was driven by the sale of "Best of" programming, rate increases to

the company's multi-subscription and Internet packages, and the

U.S. Music Royalty Fee introduced this quarter. Total ARPU for the

three months ended September 30, 2009 was $10.87, compared to

$10.51 for the three months ended September 30, 2008. The increase

was driven mainly by the sale of "Best of" programming, increased

rates on the company's multi-subscription and Internet packages,

partially offset by a decline in net advertising revenue per

average subscriber. In the third quarter 2009, the company achieved

positive adjusted income from operations of $106 million, compared

to an adjusted loss from operations of ($37) million for the third

quarter of 2008 (refer to the reconciliation table of net loss to

adjusted income (loss) from operations). The improvement was driven

by the increase in total revenue of $17 million and a $126 million,

or 19%, decrease in expenses included in adjusted income (loss)

from operations. Satellite and transmission costs decreased 26%, or

$6 million, in the three months ended September 30, 2009 compared

to the same period in 2008 due to reductions in maintenance costs,

repeater lease expense, and personnel costs. Programming and

content costs decreased 29%, or $38 million, in the three months

ended September 30, 2009 compared to the same period in 2008, due

mainly to a one-time payment recognized in 2008 to a programming

provider upon completion of the merger with XM, reductions in

personnel and on-air talent costs as well as savings on certain

content agreements. Revenue share and royalties increased 2%, or $3

million, compared to the same period in 2008, due mainly to the

increase in the company's revenues and the statutory royalty rate

for the performance of sound recordings. Customer service and

billing costs decreased 5%, or $3 million, due primarily to

reductions in personnel and customer call center expenses. Cost of

equipment decreased 26%, or $4 million, in the three months ended

September 30, 2009 compared to the same period in 2008 as a result

of a decrease in the company's direct to customer sales and lower

inventory write-downs. Sales and marketing costs decreased 32%, or

$25 million, and decreased as a percentage of revenue to 8% from

13% in the three months ended September 30, 2009 compared to the

same period in 2008. The decrease in Sales and marketing costs was

due to reduced advertising and cooperative marketing spend as well

as reductions to personnel costs and third party distribution

support expenses. Subscriber acquisition costs decreased 17%, or

$23 million, and decreased as a percentage of revenue to 17% from

22% in the three months ended September 30, 2009 compared to the

same period in 2008. SAC per gross addition declined by 7% to $69

from $74 in the year ago period. This improvement was driven by

lower OEM subsidies and lower aftermarket inventory charges as

compared to the three months ended September 30, 2008. Subscriber

acquisition costs also decreased as a result of the 13% decline in

gross additions during the three months ended September 30, 2009

compared to the three months ended September 30, 2008. General and

administrative costs decreased 36%, or $28 million, mainly due to

the absence of certain legal and regulatory charges incurred in

2008 and lower personnel costs. Engineering, design and development

costs decreased 8%, or $1 million, in the three months ended

September 30, 2009 compared to the same period in 2008, due to

lower costs associated with the manufacturing of radios, OEM

tooling and manufacturing, and personnel. Restructuring,

impairments and related costs decreased 66%, or $5 million, due to

fewer restructuring charges associated with the merger with XM.

Other expenses increased 182%, or $141 million, in the three months

ended September 30, 2009 compared to the same period in 2008 driven

mainly by the loss on extinguishment of debt and credit facilities

of $138 million, and an increase in interest expense of $12

million, partially offset by a decrease of $7 million in loss on

investments. The loss on the extinguishment of debt and credit

facilities was incurred on the full repayment of SIRIUS' Credit

Agreement with Liberty Media. Interest expense increased primarily

due to the issuance of XM's 13% Senior Notes due 2013 and the 7%

Exchangeable Senior Subordinated Notes due 2014 in the third

quarter of 2008. The decrease in loss on investments was

attributable to payments received from SIRIUS Canada in excess of

SIRIUS' carrying value of its investments, partially offset by the

company's share of SIRIUS Canada's and XM Canada's net losses for

the three months ended September 30, 2009 compared to the same

period in 2008. NINE MONTHS ENDED SEPTEMBER 30, 2009 VERSUS NINE

MONTHS ENDED SEPTEMBER 30, 2008 For the nine months ended September

30, 2009, SIRIUS XM recognized total revenue of $1,843 million

compared with $1,793 million for the nine months ended September

30, 2008. This 3%, or $50 million, increase in revenue was

primarily driven by an increase in subscriber revenue resulting

primarily from a 2% growth in weighted average subscribers over the

period as well as revenues from the sale of "Best of" programming,

rate increases to the company's multi-subscription and Internet

packages, and the U.S. Music Royalty Fee introduced in the quarter

ended September 30, 2009. Total ARPU for the nine months ended

September 30, 2009 was $10.67, compared to $10.53 for the nine

months ended September 30, 2008. The increase was driven mainly by

the sale of "Best of" programming, increased rates on the company's

multi-subscription packages and revenues earned on its Internet

packages, partially offset by a decline in net advertising revenue

per average subscriber. The company's adjusted income from

operations increased $515 million to $347 million for the nine

months ended September 30, 2009 from a loss of ($168) million for

the nine months ended September 30, 2008 (refer to the

reconciliation table of net loss to adjusted income (loss) from

operations). This increase was driven by a 3%, or $50 million,

increase in revenue and a 24%, or $465 million, decrease in

expenses included in adjusted income (loss) from operations.

Satellite and transmission costs decreased 25%, or $19 million, in

the nine months ended September 30, 2009 compared to the same

period in 2008 due to reductions in maintenance costs, repeater

lease expense, and personnel costs. Programming and content costs

decreased 19%, or $64 million, in the nine months ended September

30, 2009 compared to the same period in 2008, due mainly to a

one-time payment recognized in 2008 to a programming provider upon

completion of the merger with XM, reductions in personnel and

on-air talent costs as well as savings on certain content

agreements. Revenue share and royalties increased 2%, or $7

million, for the nine months ended September 30, 2009 compared to

the same period in 2008, mainly due to the increase in the

company's revenues and the statutory royalty rate for the

performance of sound recordings. Customer service and billing costs

decreased 2%, or $4 million, for the nine months ended September

30, 2009 compared to the same period in 2008 due to scale

efficiencies over a larger daily weighted average subscriber base.

Cost of equipment decreased 42%, or $20 million, in the nine months

ended September 30, 2009 compared to the same period in 2008 as a

result of a decrease in the company's direct to customer sales,

aftermarket inventory charges and lower inventory write-downs.

Sales and marketing costs decreased 42%, or $109 million, and

decreased as a percentage of revenue to 8% from 15% in the nine

months ended September 30, 2009 compared to the same period in

2008. The decrease was due to reduced advertising and cooperative

marketing spend as well as reductions to personnel costs and third

party distribution support expenses. Subscriber acquisition costs

decreased 38%, or $170 million, and decreased as a percentage of

revenue to 15% from 25% in the nine months ended September 30, 2009

compared to the same period in 2008. This decrease was driven by a

17% improvement in SAC, as adjusted, per gross addition due to

fewer OEM installations relative to gross subscriber additions,

decreased production of certain radios, lower OEM subsidies and

lower aftermarket inventory reserves in the nine months ended

September 30, 2009 as compared to the nine months ended September

30, 2008. Subscriber acquisition costs also decreased as a result

of the 28% decline in gross additions during the nine months ended

September 30, 2009. General and administrative costs decreased 34%,

or $73 million, mainly due to the absence of certain legal and

regulatory charges incurred in 2008 and lower personnel costs.

Engineering, design and development costs decreased 33%, or $14

million, in the nine months ended September 30, 2009 compared to

the same period in 2008, due to lower costs associated with the

manufacturing of radios, OEM tooling and manufacturing, and

personnel. Restructuring, impairments and related costs increased

$23 million mainly due to a loss of $24 million on capitalized

installment payments, offset partially by a decrease in personnel

related restructuring costs. Other expenses increased 187%, or $334

million, in the nine months ended September 30, 2009 compared to

the same period in 2008 driven mainly by the loss on extinguishment

of debt and credit facilities of $264 million, and an increase in

interest expense of $90 million, offset by an increase of $17

million in gain on investments. The loss on the extinguishment of

debt and credit facilities was incurred on the full repayment of

SIRIUS' Credit Agreement with Liberty Media and XM's Amended and

Restated Credit Agreement and its Second-Lien Credit Agreement.

Interest expense increased due primarily to the issuance of XM's

13% Senior Notes due 2013 and the 7% Exchangeable Senior

Subordinated Notes due 2014 in the third quarter of 2008. The

increase in gain on investments was attributable to payments

received from SIRIUS Canada in excess of SIRIUS' carrying value of

its investment, partially offset by the company's share of SIRIUS

Canada's and XM Canada's net losses for the nine months ended

September 30, 2009 compared to the same period in 2008. Unaudited

------------------------------------------ Three Months Ended Nine

Months Ended September 30, September 30, -----------------

----------------- 2009 2008 2009 2008 ---- ---- ---- ---- (Actual)

(Pro Forma) (Actual) (Pro Forma) Beginning subscribers 18,413,435

18,576,830 19,003,856 17,348,622 Gross subscriber additions

1,606,446 1,843,785 4,325,532 5,997,096 Deactivated subscribers

(1,504,151) (1,499,704) (4,813,658) (4,424,807) ----------

---------- ---------- ---------- Net additions 102,295 344,081

(488,126) 1,572,289 ------- ------- -------- --------- Ending

subscribers 18,515,730 18,920,911 18,515,730 18,920,911 ==========

========== ========== ========== Retail 7,925,904 9,036,420

7,925,904 9,036,420 OEM 10,488,530 9,777,704 10,488,530 9,777,704

Rental 101,296 106,787 101,296 106,787 ------- ------- -------

------- Ending subscribers 18,515,730 18,920,911 18,515,730

18,920,911 ========== ========== ========== ========== Retail

(309,972) (149,417) (979,298) (202,295) OEM 407,131 492,216 492,692

1,744,436 Rental 5,136 1,282 (1,520) 30,148 ----- ----- ------

------ Net additions 102,295 344,081 (488,126) 1,572,289 =======

======= ======== ========= Self-pay 15,456,748 15,190,588

15,456,748 15,190,588 Paid promotional 3,058,982 3,730,323

3,058,982 3,730,323 --------- --------- --------- --------- Ending

subscribers 18,515,730 18,920,911 18,515,730 18,920,911 ==========

========== ========== ========== Self-pay 35,405 361,438 (92,838)

1,317,242 Paid promotional 66,890 (17,357) (395,288) 255,047 ------

------- -------- ------- Net additions 102,295 344,081 (488,126)

1,572,289 ======= ======= ======== ========= Daily weighted average

number of subscribers 18,393,678 18,710,940 18,514,041 18,187,927

========== ========== ========== ========== Unaudited Pro Forma

----------------------------------------- Three Months Ended Nine

Months Ended (in thousands, except September 30, September 30, for

per subscriber --------------- ---------------- amounts) 2009 2008

2009 2008 ---- ---- ---- ---- Average self-pay monthly churn (1)(7)

2.0% 1.7% 2.1% 1.7% Conversion rate (2)(7) 46.8% 47.0% 45.3% 49.2%

ARPU (3)(7) $10.87 $10.51 $10.67 $10.53 SAC, as adjusted, per gross

subscriber addition (4)(7) $69 $74 $63 $76 Customer service and

billing expenses, as adjusted, per average subscriber (5)(7) $1.01

$1.05 $1.04 $1.08 Total revenue $629,607 $612,776 $1,842,924

$1,792,632 Free cash flow (6)(7) $26,724 $(97,594) $35,772

$(577,648) Adjusted income (loss) from operations (8) $106,140

$(36,851) $347,198 $(168,096) Net loss $(181,935) $(217,010)

$(416,090) $(653,867) Unaudited Pro Forma

------------------------------------------ Three Months Ended Nine

Months Ended September 30, September 30, ---------------

---------------- (in thousands) 2009 2008 2009 2008 ---- ---- ----

---- Revenue: Subscriber revenue, including effects of rebates

$587,442 $572,355 $1,740,477 $1,669,700 Advertising revenue, net of

agency fees 12,418 17,867 37,287 54,156 Equipment revenue 10,506

12,856 31,343 38,687 Other revenue 19,241 9,698 33,817 30,089

------ ----- ------ ------ Total revenue 629,607 612,776 1,842,924

1,792,632 Operating expenses: Satellite and transmission 18,676

25,136 57,077 76,336 Programming and content 93,230 131,630 277,614

341,422 Revenue share and royalties 123,531 120,800 362,463 355,251

Customer service and billing 55,795 58,857 173,517 177,159 Cost of

equipment 11,944 16,179 27,988 48,020 Sales and marketing 52,827

78,178 152,039 260,583 Subscriber acquisition costs 109,384 132,477

274,082 444,396 General and administrative 48,481 75,981 142,812

215,440 Engineering, design and development 9,599 10,389 28,134

42,121 Depreciation and amortization 47,997 64,111 145,596 196,051

Share-based payment expense 18,799 29,809 71,301 99,673

Restructuring, impairments and related costs 2,554 7,430 30,167

7,457 ----- ----- ------ ----- Total operating expenses 592,817

750,977 1,742,790 2,263,909 ------- ------- --------- ---------

Income (loss) from operations 36,790 (138,201) 100,134 (471,277)

Other expense (217,610) (77,086) (512,880) (178,777) --------

------- -------- -------- Loss before income taxes (180,820)

(215,287) (412,746) (650,054) Income tax expense (1,115) (1,723)

(3,344) (3,813) ------ ------ ------ ------ Net loss $(181,935)

$(217,010) $(416,090) $(653,867) ========= ========= =========

========= Unaudited Actual

------------------------------------------- For the Three For the

Nine Months Ended Months Ended September 30, September 30, (in

thousands, except ----------------- ----------------- per share

data) 2009 2008 2009 2008 ---- ---- ---- ---- Revenue: Subscriber

revenue, including effects of rebates $578,304 $458,237 $1,699,455

$980,396 Advertising revenue, net of agency fees 12,418 14,674

37,287 31,413 Equipment revenue 10,506 11,271 31,343 25,290 Other

revenue 17,428 4,261 28,379 4,710 ------ ----- ------ ----- Total

revenue 618,656 488,443 1,796,464 1,041,809 Operating expenses

(depreciation and amortization shown separately below) (1): Cost of

services: Satellite and transmission 19,542 19,526 59,435 34,800

Programming and content 78,315 106,037 230,825 222,975 Revenue

share and royalties 100,558 85,592 296,855 177,635 Customer service

and billing 56,529 47,432 175,570 97,218 Cost of equipment 11,944

13,773 27,988 28,007 Sales and marketing 52,530 63,637 152,647

151,237 Subscriber acquisition costs 90,054 86,616 230,773 257,832

General and administrative 56,923 57,310 182,953 148,555

Engineering, design and development 11,252 10,434 32,975 28,091

Impairment of goodwill - 4,750,859 - 4,750,859 Depreciation and

amortization 72,100 66,774 231,624 120,793 Restructuring,

impairments and related costs 2,554 7,430 30,167 7,457 ----- -----

------ ----- Total operating expenses 552,301 5,315,420 1,651,812

6,025,459 ------- --------- --------- --------- Income (loss) from

operations 66,355 (4,826,977) 144,652 (4,983,650) Other income

(expense): Interest and investment income 962 4,940 2,602 9,167

Interest expense, net of amounts capitalized (78,527) (49,216)

(240,062) (83,636) Loss on extinguishment of debt and credit

facilities, net (138,053) - (263,767) - (Loss) gain on investments

(58) (3,089) 457 (3,089) Other income (expense) 1,246 (3,870) 2,505

(3,935) ----- ------ ----- ------ Total other expense (214,430)

(51,235) (498,265) (81,493) -------- ------- -------- ------- Loss

before income taxes (148,075) (4,878,212) (353,613) (5,065,143)

Income tax expense (1,115) (1,215) (3,344) (2,301) --------

---------- -------- ---------- Net loss (149,190) (4,879,427)

(356,957) (5,067,444) Preferred stock beneficial conversion feature

- - (186,188) - --- --- -------- --- Net loss attributable to

common stockholders $(149,190) $(4,879,427) $(543,145) $(5,067,444)

========= =========== ========= =========== Net loss per common

share (basic and diluted) $(0.04) $(1.93) $(0.15) $(2.76) ======

====== ====== ====== Weighted average common shares outstanding

(basic and diluted) 3,621,062 2,527,692 3,577,587 1,836,834

========= ========= ========= ========= -------------------------

(1) Amounts related to share-based payment expense included in

operating expenses were as follows: Satellite and transmission

$1,086 $1,331 $3,020 $2,887 Programming and content 3,037 3,529

7,418 7,477 Customer service and billing 734 596 2,052 1,137 Sales

and marketing 2,722 3,672 10,081 11,376 Subscriber acquisition

costs - - - 14 General and administrative 8,442 12,904 40,141

36,359 Engineering, design and development 1,653 1,973 4,841 4,167

----- ----- ----- ----- Total share-based payment expense $17,674

$24,005 $67,553 $63,417 ======= ======= ======= ======= September

December 30, 2009 31, 2008 (in thousands, except share and --------

--------- per share data) (Unaudited) ASSETS Current assets: Cash

and cash equivalents $380,372 $380,446 Accounts receivable, net of

allowance for doubtful accounts of $9,872 and $10,860, respectively

87,148 102,024 Receivables from distributors 41,755 45,950

Inventory, net 20,996 24,462 Prepaid expenses 107,350 67,203

Related party current assets 109,172 114,177 Other current assets

64,317 58,744 ------ ------ Total current assets 811,110 793,006

Property and equipment, net 1,694,235 1,703,476 FCC licenses

2,083,654 2,083,654 Restricted investments 3,400 141,250 Deferred

financing fees, net 35,889 40,156 Intangible assets, net 629,288

688,671 Goodwill 1,834,856 1,834,856 Related party long-term assets

114,073 124,607 Other long-term assets 62,438 81,019 ------ ------

Total assets $7,268,943 $7,490,695 ========== ==========

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable and accrued expenses $521,621 $642,820 Accrued interest

65,537 76,463 Current portion of deferred revenue 987,177 985,180

Current portion of deferred credit on executory contracts 247,566

234,774 Current maturities of long-term debt 103,674 399,726

Related party current liabilities 90,869 68,373 ------ ------ Total

current liabilities 2,016,444 2,407,336 Deferred revenue 285,488

247,889 Deferred credit on executory contracts 851,955 1,037,190

Long-term debt 2,874,391 2,851,740 Long-term related party debt

265,659 - Deferred tax liability 906,428 894,453 Related party

long-term liabilities 21,928 - Other long-term liabilities 39,005

43,550 ------ ------ Total liabilities 7,261,298 7,482,158

--------- --------- Commitments and contingencies Stockholders'

equity: Preferred stock, par value $0.001; 50,000,000 authorized at

September 30, 2009 and December 31, 2008: Series A convertible

preferred stock (liquidation preference of $51,370 at September 30,

2009 and December 31, 2008); 24,808,959 shares issued and

outstanding at September 30, 2009 and December 31, 2008 25 25

Convertible perpetual preferred stock, series B (liquidation

preference of $13 and $0 at September 30, 2009 and December 31,

2008, respectively); 12,500,000 and zero shares issued and

outstanding at September 30, 2009 and December 31, 2008,

respectively 13 - Convertible preferred stock, series C junior; no

shares issued and outstanding at September 30, 2009 and December

31, 2008 - - Common stock, par value $0.001; 9,000,000,000 and

8,000,000,000 shares authorized at September 30, 2009 and December

31, 2008, respectively; 3,858,186,839 and 3,651,765,837 shares

issued and outstanding at September 30, 2009 and December 31, 2008,

respectively 3,858 3,652 Accumulated other comprehensive loss, net

of tax (6,598) (7,871) Additional paid-in capital 10,265,752

9,724,991 Accumulated deficit (10,255,405) (9,712,260) -----------

---------- Total stockholders' equity 7,645 8,537 ----- ----- Total

liabilities and stockholders' equity $7,268,943 $7,490,695

========== ========== Unaudited For the Nine Months Ended September

30, ------------------- (in thousands) 2009 2008 ---- ---- Cash

flows from operating activities: Net loss $(356,957) $(5,067,444)

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: Depreciation and amortization 231,624 114,923

Impairment of goodwill - 4,750,859 Non-cash interest expense, net

of amortization of premium 32,909 (1,933) Provision for doubtful

accounts 23,879 11,125 Amortization of deferred income related to

equity method investment (2,082) (471) Loss on extinguishment of

debt and credit facilities, net 263,767 - Restructuring,

impairments and related costs 26,954 - Loss on disposal of assets -

4,879 Loss on investments 10,967 3,089 Share-based payment expense

67,553 63,417 Deferred income taxes 3,344 2,301 Other non-cash

purchase price adjustments (142,487) (23,770) Other - 1,643 Changes

in operating assets and liabilities: Accounts receivable (9,002)

1,575 Inventory 3,466 2,952 Receivables from distributors 4,195

9,595 Related party assets 15,539 (1,357) Prepaid expenses and

other current assets 30,188 3,528 Other long-term assets 64,034

37,110 Accounts payable and accrued expenses (68,135) (122,969)

Accrued interest (6,600) (2,810) Deferred revenue 11,569 (4,577)

Related party liabilities 44,424 3,315 Other long-term liabilities

3,958 (1,972) ----- ------ Net cash provided by (used in) operating

activities 253,107 (216,992) ------- -------- Cash flows from

investing activities: Additions to property and equipment (217,335)

(102,705) Sales of property and equipment - 105 Purchases of

restricted and other investments - (3,000) Acquisition of acquired

entity cash - 819,521 Merger related costs - (13,047) Sale of

restricted and other investments - 65,642 --- ------ Net cash (used

in) provided by investing activities (217,335) 766,516 --------

------- Cash flows from financing activities: Proceeds from

exercise of warrants and stock options - 471 Preferred stock

issuance costs, net (3,712) - Long-term borrowings, net 579,936

533,941 Related party long-term borrowings, net 364,964 -

Short-term financings 2,220 - Payment of premiums on redemption of

debt (17,075) (18,693) Payments to minority interest holder -

(61,880) Repayment of long-term borrowings (610,932) (1,082,428)

Repayment of related party long-term borrowings (351,247) - Other -

(98) --- --- Net cash used in financing activities (35,846)

(628,687) ------- -------- Net decrease in cash and cash

equivalents (74) (79,163) Cash and cash equivalents at beginning of

period 380,446 438,820 ------- ------- Cash and cash equivalents at

end of period $380,372 $359,657 ======== ======== FOOTNOTES TO

PRESS RELEASE AND TABLES FOR NON-GAAP FINANCIAL MEASURES (1)

Average self-pay monthly churn represents the monthly average of

self-pay deactivations by the quarter divided by the average

self-pay subscriber balance for the quarter. (2) We measure the

percentage of subscribers that receive our service and convert to

self-paying after the initial promotion period. We refer to this as

the "conversion rate." At the time of sale, vehicle owners

generally receive between three and twelve month prepaid trial

subscriptions and we receive a subscription fee from the OEM.

Promotional periods generally include the period of trial service

plus 30 days to handle the receipt and processing of payments. We

measure conversion rate three months after the period in which the

trial service ends. Based on our experience it may take up to 90

days after the trial service ends for subscribers to respond to our

marketing communications and become self-paying subscribers. (3)

ARPU is derived from total earned subscriber revenue and net

advertising revenue, divided by the number of months in the period,

divided by the daily weighted average number of subscribers for the

period. ARPU is calculated as follows (in thousands, except for per

subscriber amounts): Unaudited Pro Forma

---------------------------------------- Three Months Ended Nine

Months Ended September 30, September 30, ---------------

---------------- 2009 2008 2009 2008 ---- ---- ---- ---- Subscriber

revenue $587,442 $572,355 $1,740,477 $1,669,700 Net advertising

revenue 12,418 17,867 37,287 54,156 ------ ------ ------ ------

Total subscriber and net advertising revenue $599,860 $590,222

$1,777,764 $1,723,856 ======== ======== ========== ========== Daily

weighted average number of subscribers 18,393,678 18,710,940

18,514,041 18,187,927 ARPU $10.87 $10.51 $10.67 $10.53 (4) SAC, as

adjusted, per gross subscriber addition is derived from subscriber

acquisition costs and margins from the direct sale of radios and

accessories, excluding share-based payment expense divided by the

number of gross subscriber additions for the period. SAC, as

adjusted, per gross subscriber addition is calculated as follows

(in thousands, except for per subscriber amounts): Unaudited Pro

Forma -------------------------------------- Three Months Ended

Nine Months Ended September 30, September 30, ---------------

--------------- 2009 2008 2009 2008 ---- ---- ---- ---- Subscriber

acquisition cost $109,384 $132,477 $274,082 $444,410 Less:

share-based payment expense granted to third parties and employees

- - - (14) Less/Add: margin from direct sales of radios and

accessories 1,438 3,323 (3,355) 9,333 ----- ----- ------ ----- SAC,

as adjusted $110,822 $135,800 $270,727 $453,729 ======== ========

======== ======== Gross subscriber additions 1,606,446 1,843,785

4,325,532 5,997,096 SAC, as adjusted, per gross subscriber addition

$69 $74 $63 $76 (5) Customer service and billing expenses, as

adjusted, per average subscriber is derived from total customer

service and billing expenses, excluding share-based payment

expense, divided by the number of months in the period, divided by

the daily weighted average number of subscribers for the period.

Customer service and billing expenses, as adjusted, per average

subscriber is calculated as follows (in thousands, except for per

subscriber amounts): Unaudited Pro Forma

------------------------------------------ Three Months Ended Nine

Months Ended September 30, September 30, ----------------

---------------- 2009 2008 2009 2008 ---- ---- ---- ---- Customer

service and billing expenses $56,644 $59,786 $175,928 $180,270

Less: share-based payment expense (849) (929) (2,411) (3,111) ----

---- ------ ------ Customer service and billing expenses, as

adjusted $55,795 $58,857 $173,517 $177,159 ======= ======= ========

======== Daily weighted average number of subscribers 18,393,678

18,710,940 18,514,041 18,187,927 Customer service and billing

expenses, as adjusted, per average subscriber $1.01 $1.05 $1.04

$1.08 (6) Free cash flow is calculated as follows: Unaudited Pro

Forma -------------------------------------- Three Months Ended

Nine Months Ended September 30, September 30, ---------------

--------------- (in thousands) 2009 2008 2009 2008 ---- ---- ----

---- Net cash provided by (used in) operating activities $116,248

$(101,983) $253,107 $(468,078) Additions to property and equipment

(89,524) (32,403) (217,335) (133,548) Merger related costs - 1,796

- (13,047) Restricted and other investment activity - 34,996 -

37,025 --- ------ --- ------ Free cash flow $26,724 $(97,594)

$35,772 $(577,648) ======= ======== ======= ========= (7) Average

self-pay monthly churn; conversion rate; ARPU; SAC, as adjusted,

per gross subscriber addition; customer service and billing

expenses, as adjusted, per average subscriber; and free cash flow

are not measures of financial performance under U.S. generally

accepted accounting principles ("GAAP"). We believe these non-GAAP

financial measures provide meaningful supplemental information

regarding our operating performance and are used by us for

budgetary and planning purposes; when publicly providing our

business outlook; as a means to evaluate period-to-period

comparisons; and to compare our performance to that of our

competitors. We also believe that investors also use our current

and projected metrics to monitor the performance of our business

and to make investment decisions. We believe the exclusion of

share-based payment expense in our calculations of SAC, as

adjusted, per gross subscriber addition and customer service and

billing expenses, as adjusted, per average subscriber is useful

given the significant variation in expense that can result from

changes in the fair market value of our common stock, the effect of

which is unrelated to the operational conditions that give rise to

variations in the components of our subscriber acquisition costs

and customer service and billing expenses. Specifically, the

exclusion of share-based payment expense in our calculation of SAC,

as adjusted, per gross subscriber addition is critical in being

able to understand the economic impact of the direct costs incurred

to acquire a subscriber and the effect over time as economies of

scale are reached. These non-GAAP financial measures are used in

addition to and in conjunction with results presented in accordance

with GAAP. These non-GAAP financial measures may be susceptible to

varying calculations; may not be comparable to other similarly

titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of

financial performance prepared in accordance with GAAP. (8) We

refer to net loss before interest and investment income, interest

expense net of amounts capitalized, income tax expense, loss from

redemption of debt, loss on investments, other expense (income),

restructuring and related cost, depreciation and amortization, and

share related payment expense as adjusted income (loss) from

operations. Adjusted income (loss) from operations is not a measure

of financial performance under U.S. GAAP. We believe adjusted

income (loss) from operations is a useful measure of our operating

performance. We use adjusted income (loss) from operations for

budgetary and planning purposes; to assess the relative

profitability and on-going performance of our consolidated

operations; to compare our performance from period-to-period; and

to compare our performance to that of our competitors. We also

believe adjusted income (loss) from operations is useful to

investors to compare our operating performance to the performance

of other communications, entertainment and media companies. We

believe that investors use current and projected adjusted income

(loss) from operations to estimate our current or prospective

enterprise value and to make investment decisions. Because we fund

and build-out our satellite radio system through the periodic

raising and expenditure of large amounts of capital, our results of

operations reflect significant charges for interest and

depreciation expense. We believe adjusted income (loss) from

operations provides useful information about the operating

performance of our business apart from the costs associated with

our capital structure and physical plant. The exclusion of interest

and depreciation and amortization expense is useful given

fluctuations in interest rates and significant variation in

depreciation and amortization expense that can result from the

amount and timing of capital expenditures and potential variations

in estimated useful lives, all of which can vary widely across

different industries or among companies within the same industry.

We believe the exclusion of taxes is appropriate for comparability

purposes as the tax positions of companies can vary because of

their differing abilities to take advantage of tax benefits and

because of the tax policies of the various jurisdictions in which

they operate. We believe the exclusion of restructuring and related

costs is useful given the non-recurring nature of these

transactions. We also believe the exclusion of share- based payment

expense is useful given the significant variation in expense that

can result from changes in the fair market value of our common

stock. To compensate for the exclusion of taxes, other income

(expense), depreciation and amortization and share-based payment

expense, we separately measure and budget for these items. There

are material limitations associated with the use of adjusted income

(loss) from operations in evaluating our company compared with net

loss, which reflects overall financial performance, including the

effects of taxes, other income (expense), depreciation and

amortization, restructuring and related costs, and share-based

payment expense. We use adjusted income (loss) from operations to

supplement GAAP results to provide a more complete understanding of

the factors and trends affecting the business than GAAP results

alone. Investors that wish to compare and evaluate our operating

results after giving effect for these costs, should refer to net

loss as disclosed in our unaudited condensed consolidated

statements of operations. Since adjusted income (loss) from

operations is a non- GAAP financial measure, our calculation of

adjusted income (loss) from operations may be susceptible to

varying calculations; may not be comparable to other similarly

titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of

financial performance prepared in accordance with GAAP. The

reconciliation of the pro forma unadjusted net loss to the pro

forma adjusted income (loss) from operations is calculated as

follows (see footnotes for reconciliation of the pro forma amounts

to their respective GAAP amounts): Unaudited Pro Forma

-------------------------------------- Three Months Ended Nine

Months Ended September 30, September 30, ---------------

--------------- (in thousands) 2009 2008 2009 2008 ---- ---- ----

---- Reconciliation of Net loss to Adjusted income (loss) from

operations: Net loss $(181,935) $(217,010) $(416,090) $(653,867)

Add back Net loss items excluded from Adjusted income (loss) from

operations: Interest and investment income (962) (5,534) (2,602)

(12,180) Interest expense, net of amounts capitalized 81,707 70,153

254,677 164,380 Income tax expense 1,115 1,723 3,344 3,813 Loss on

extinguishment of debt and facilities, net 138,053 - 263,767 - Loss

(gain) on investments 58 7,549 (457) 16,099 Other (income) expense

(1,246) 4,918 (2,505) 10,478 ------ ----- ------ ------ Income

(loss) from operations 36,790 (138,201) 100,134 (471,277)

Restructuring, impairments and related costs 2,554 7,430 30,167

7,457 Depreciation and amortization 47,997 64,111 145,596 196,051

Share-based payment expense 18,799 29,809 71,301 99,673 ------

------ ------ ------ Adjusted income (loss) from operations

$106,140 $(36,851) $347,198 $(168,096) ======== ======== ========

========= There are material limitations associated with the use of

a pro forma unadjusted results of operations in evaluating our

company compared with our GAAP results of operations, which

reflects overall financial performance. We use pro forma unadjusted

results of operations to supplement GAAP results to provide a more

complete understanding of the factors and trends affecting the

business than GAAP results alone. Investors that wish to compare

and evaluate our operating results after giving effect for these

costs, should refer to results of operations as disclosed in our

unaudited condensed consolidated statements of operations. Since

pro forma unadjusted results of operations is a non-GAAP financial

measure, our calculations may not be comparable to other similarly

titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of

financial performance prepared in accordance with GAAP. (9) The

following tables reconcile our GAAP results of operations to our

non-GAAP pro forma unadjusted results of operations (in thousands):

Unaudited For the Three Months Ended September 30, 2009

----------------------------------------- Allocation of Purchase

Share- Price based As Accounting Payment Pro Reported Adjustments

Expense Forma -------- ----------- -------- ----- Revenue:

Subscriber revenue, including effects of rebates $578,304 $9,138 $-

$587,442 Advertising revenue, net of agency fees 12,418 - - 12,418

Equipment revenue 10,506 - - 10,506 Other revenue 17,428 1,813 -

19,241 ------ ----- --- ------ Total revenue 618,656 10,951 -

629,607 Operating expenses (excludes depreciation and amortization

shown separately below) (1) Cost of services: Satellite and

transmission 19,542 331 (1,197) 18,676 Programming and content

78,315 18,117 (3,202) 93,230 Revenue share and royalties 100,558

22,973 - 123,531 Customer service and billing 56,529 115 (849)

55,795 Cost of equipment 11,944 - - 11,944 Sales and marketing

52,530 3,155 (2,858) 52,827 Subscriber acquisition costs 90,054

19,330 - 109,384 General and administrative 56,923 374 (8,816)

48,481 Engineering, design and development 11,252 224 (1,877) 9,599

Depreciation and amortization 72,100 (24,103) - 47,997 Share-based

payment expense - - 18,799 18,799 Restructuring, impairments and

related costs 2,554 - - 2,554 ----- --- --- ----- Total operating

expenses 552,301 40,516 - 592,817 ------- ------ --- ------- Income

(loss) from operations 66,355 (29,565) - 36,790 Other income

(expense) Interest and investment income 962 - - 962 Interest

expense, net of amounts capitalized (78,527) (3,180) - (81,707)

Loss on extinguishment of debt and facilities, net (138,053) - -

(138,053) Loss on investments (58) - - (58) Other income 1,246 - -

1,246 ----- --- --- ----- Total other expense (214,430) (3,180) -

(217,610) -------- ------ --- -------- Loss before income taxes

(148,075) (32,745) - (180,820) Income tax expense (1,115) - -

(1,115) ------ --- --- ------ Net loss $(149,190) $(32,745) $-

$(181,935) ========= ======== === ========= (1) Amounts related to

share-based payment expense included in operating expenses were as

follows: Satellite and transmission $1,086 $111 $- $1,197

Programming and content 3,037 165 - 3,202 Customer service and

billing 734 115 - 849 Sales and marketing 2,722 136 - 2,858

Subscriber acquisition costs - - - - General and administrative

8,442 374 - 8,816 Engineering, design and development 1,653 224 -

1,877 ----- --- --- ----- Total share-based payment expense $17,674

$1,125 $- $18,799 ======= ====== === ======= Unaudited For the

Three Months Ended September 30, 2008

------------------------------------------------ Purchase

Allocation Price of Predecessor Accounting Share- Financial Adjust-

based As Inform- ments Payment Pro Reported ation (a) Expense Forma

-------- ----- ----- ------- ----- Revenue: Subscriber revenue,

including effects of rebates $458,237 $95,684 $18,434 $- $572,355

Advertising revenue, net of agency fees 14,674 3,193 - - 17,867

Equipment revenue 11,271 1,585 - - 12,856 Other revenue 4,261 4,242

1,195 - 9,698 ----- ----- ----- --- ----- Total revenue 488,443

104,704 19,629 - 612,776 Operating expenses (excludes depreciation

and amortization shown separately below) (1) Cost of services:

Satellite and transmission 19,526 6,644 638 (1,672) 25,136

Programming and content 106,037 15,991 13,912 (4,310) 131,630

Revenue share and royalties 85,592 24,198 11,010 - 120,800 Customer

service and billing 47,432 12,249 105 (929) 58,857 Cost of

equipment 13,773 2,406 - - 16,179 Sales and marketing 63,637 17,268

2,081 (4,808) 78,178 Subscriber acquisition costs 86,616 33,366

12,495 - 132,477 General and administrative 57,310 33,209 777

(15,315) 75,981 Engineering, design and development 10,434 2,611

119 (2,775) 10,389 Impairment of goodwill 4,750,859 - (4,750,859) -

- Depreciation and amortization 66,774 10,828 (13,491) - 64,111

Restructuring, impairments and related costs 7,430 - - - 7,430

Share-based payment expense - - - 29,809 29,809 --- --- --- ------

------ Total operating expenses 5,315,420 158,770 (4,723,213) -

750,977 --------- ------- ---------- --- ------- Loss from

operations (4,826,977) (54,066) 4,742,842 - (138,201) Other income

(expense) Interest and investment income 4,940 594 - - 5,534

Interest expense, net of amounts capitalized (49,216) (14,130)

(6,807) - (70,153) Loss on extinguishment of debt and facilities,

net - - - - - Loss on investments (3,089) (4,460) - - (7,549) Other

expense (3,870) (1,048) - - (4,918) ------ ------ --- --- ------

Total other expense (51,235) (19,044) (6,807) - (77,086) -------

------- ------ --- ------- Loss before income taxes (4,878,212)

(73,110) 4,736,035 - (215,287) Income tax expense (1,215) (508) - -

(1,723) ------ ---- --- --- ------ Net loss $(4,879,427) $(73,618)

$4,736,035 $- $(217,010) =========== ======== ========== ===

========= (1) Amounts related to share-based payment expense

included in operating expenses were as follows: Satellite and

transmission $1,331 $305 $36 $- $1,672 Programming and content

3,529 586 195 - 4,310 Customer service and billing 596 228 105 -

929 Sales and marketing 3,672 770 366 - 4,808 Subscriber

acquisition costs - - - - - General and administrative 12,904 1,634

777 - 15,315 Engineering, design and development 1,973 510 292 -

2,775 ----- --- --- --- ----- Total share-based payment expense

$24,005 $4,033 $1,771 $- $29,809 ======= ====== ====== === =======

------------------------------ (a) Includes impairment of goodwill.

Unaudited For the Nine Months Ended September 30, 2009

---------------------------------------- Allocation of Purchase

Share- Price based As Accounting Payment Pro Reported Adjustments

Expense Forma -------- ----------- ------- ----- Revenue:

Subscriber revenue, including effects of rebates $1,699,455 $41,022

$- $1,740,477 Advertising revenue, net of agency fees 37,287 - -

37,287 Equipment revenue 31,343 - - 31,343 Other revenue 28,379

5,438 - 33,817 ------ ----- --- ------ Total revenue 1,796,464

46,460 - 1,842,924 Operating expenses (excludes depreciation and

amortization shown separately below) (1) Cost of services:

Satellite and transmission 59,435 1,013 (3,371) 57,077 Programming

and content 230,825 54,708 (7,919) 277,614 Revenue share and

royalties 296,855 65,608 - 362,463 Customer service and billing

175,570 358 (2,411) 173,517 Cost of equipment 27,988 - - 27,988

Sales and marketing 152,647 9,986 (10,594) 152,039 Subscriber

acquisition costs 230,773 43,309 - 274,082 General and

administrative 182,953 1,252 (41,393) 142,812 Engineering, design

and development 32,975 772 (5,613) 28,134 Depreciation and

amortization 231,624 (86,028) - 145,596 Share-based payment expense

- - 71,301 71,301 Restructuring, impairments and related costs

30,167 - - 30,167 ------ --- --- ------ Total operating expenses

1,651,812 90,978 - 1,742,790 --------- ------ --- --------- Income

(loss) from operations 144,652 (44,518) - 100,134 Other income

(expense) Interest and investment income 2,602 - - 2,602 Interest

expense, net of amounts capitalized (240,062) (14,615) - (254,677)

Loss on extinguishment of debt and facilities, net (263,767) - -

(263,767) Gain on investments 457 - - 457 Other income 2,505 - -

2,505 ----- --- --- ----- Total other expense (498,265) (14,615) -

(512,880) -------- ------- --- -------- Loss before income taxes

(353,613) (59,133) - (412,746) Income tax expense (3,344) - -

(3,344) ------ --- --- ------ Net loss $(356,957) $(59,133) $-

$(416,090) ========= ======== === ========= (1) Amounts related to

share-based payment expense included in operating expenses were as

follows: Satellite and transmission $3,020 $351 $- $3,371

Programming and content 7,418 501 - 7,919 Customer service and

billing 2,052 359 - 2,411 Sales and marketing 10,081 513 - 10,594

Subscriber acquisition costs - - - - General and administrative

40,141 1,252 - 41,393 Engineering, design and development 4,841 772

- 5,613 ----- --- --- ----- Total share-based payment expense

$67,553 $3,748 $- $71,301 ======= ====== === ======= Unaudited For

the Nine Months Ended September 30, 2008

--------------------------------------------------- Purchase

Allocation Price of Predecessor Accounting Share- Financial Adjust-

based As Inform- ments Payment Pro Reported ation (a) Expense Forma

-------- ----- ----- ------- ----- Revenue: Subscriber revenue,

including effects of rebates $980,396 $670,870 $18,434 $-

$1,669,700 Advertising revenue, net of agency fees 31,413 22,743 -

- 54,156 Equipment revenue 25,290 13,397 - - 38,687 Other revenue

4,710 24,184 1,195 - 30,089 ----- ------ ----- --- ------ Total

revenue 1,041,809 731,194 19,629 - 1,792,632 Operating expenses

(excludes depreciation and amortization shown separately below) (1)

Cost of services: Satellite and transmission 34,800 46,566 638

(5,668) 76,336 Programming and content 222,975 117,156 13,912

(12,621) 341,422 Revenue share and royalties 177,635 166,606 11,010

- 355,251 Customer service and billing 97,218 82,947 105 (3,111)

177,159 Cost of equipment 28,007 20,013 - - 48,020 Sales and

marketing 151,237 126,054 2,081 (18,789) 260,583 Subscriber

acquisition costs 257,832 174,083 12,495 (14) 444,396 General and

administrative 148,555 116,444 777 (50,336) 215,440 Engineering,

design and development 28,091 23,045 119 (9,134) 42,121 Impairment

of goodwill 4,750,859 - (4,750,859) - - Depreciation and

amortization 120,793 88,749 (13,491) - 196,051 Restructuring,

impairments and related costs 7,457 - - - 7,457 Share-based payment

expense - - - 99,673 99,673 --- --- --- ------ ------ Total

operating expenses 6,025,459 961,663 (4,723,213) - 2,263,909

--------- ------- ---------- --- --------- Loss from operations

(4,983,650) (230,469) 4,742,842 - (471,277) Other income (expense)

Interest and investment income 9,167 3,013 - - 12,180 Interest

expense, net of amounts capitalized (83,636) (73,937) (6,807) -

(164,380) Loss on extinguishment of debt and facilities, net - - -

- - Loss on investments (3,089) (13,010) - - (16,099) Other expense

(3,935) (6,543) - - (10,478) ------ ------ --- --- ------- Total

other expense (81,493) (90,477) (6,807) - (178,777) ------- -------

------ --- -------- Loss before income taxes (5,065,143) (320,946)

4,736,035 - (650,054) Income tax expense (2,301) (1,512) - -

(3,813) ------ ------ --- --- ------ Net loss $(5,067,444)

$(322,458) $4,736,035 $- $(653,867) =========== =========

========== === ========= (1) Amounts related to share-based payment

expense included in operating expenses were as follows: Satellite

and transmission $2,887 $2,745 $36 $- $5,668 Programming and

content 7,477 4,949 195 - 12,621 Customer service and billing 1,137

1,869 105 - 3,111 Sales and marketing 11,376 7,047 366 - 18,789

Subscriber acquisition costs 14 - - - 14 General and administrative

36,359 13,200 777 - 50,336 Engineering, design and development

4,167 4,675 292 - 9,134 ----- ----- --- --- ----- Total share-based

payment expense $63,417 $34,485 $1,771 $- $99,673 ======= =======

====== === ======= ------------------------------ (a) Includes

impairment of goodwill. (10) The following table reconciles our

GAAP Net loss per common share (basic and diluted) to our non-GAAP

Net loss per common share (basic and diluted) excluding the

following charges: (a) preferred stock beneficial conversion

feature, (b) loss on extinguishment of debt and credit facilities,

net, and (c) loss on impairment of goodwill. Unaudited

----------------------------------------- Three Months Ended Nine

Months Ended September 30, September 30, (per share data includes

------------------ ----------------- basic and diluted) 2009 2008

2009 2008 ---- ---- ---- ---- Net loss per common share $(0.04)

$(1.93) $(0.15) $(2.76) Less: Preferred stock beneficial conversion

feature - - (0.05) - --- --- ----- --- Net loss per common share

excluding preferred stock beneficial conversion feature (0.04)

(1.93) (0.10) (2.76) Less: Loss on extinguishment of debt and

credit facilities, net (0.04) - (0.07) - ----- --- ----- --- Net

loss per common share excluding loss on extinguishment of debt and

credit facilities, net and preferred stock beneficial conversion

feature (0.00) (1.93) (0.03) (2.76) Less: Impairment of goodwill -

(1.88) - (2.59) --- ----- --- ----- Net loss per common share,

excluding charges $(0.00) $(0.05) $(0.03) $(0.17) ====== ======

====== ====== About SIRIUS XM Radio SIRIUS XM Radio is America's

satellite radio company delivering to subscribers commercial-free

music channels, premier sports, news, talk, entertainment, and

traffic and weather. SIRIUS XM Radio has content relationships with

an array of personalities and artists, including Howard Stern,

Martha Stewart, Oprah Winfrey, Rosie O'Donnell, Jamie Foxx, Barbara

Walters, Opie & Anthony, Bubba the Love Sponge®, Bob Edwards,

Chris "Mad Dog" Russo, Jimmy Buffett, The Grateful Dead, Willie

Nelson, Bob Dylan and Tom Petty. SIRIUS XM Radio is the leader in

sports programming as the Official Satellite Radio Partner of the

NFL, Major League Baseball®, NASCAR®, NBA, NHL®, and PGA TOUR® and

major college sports. SIRIUS XM Radio has arrangements with every

major automaker. SIRIUS XM Radio products are available at

shop.sirius.com and shop.xmradio.com, and at retail locations

nationwide, including Best Buy, RadioShack, Wal-Mart and

independent retailers. SIRIUS XM Radio also offers SIRIUS Backseat

TV, the first ever live in-vehicle rear seat entertainment

featuring Nickelodeon, Disney Channel and Cartoon Network; XM

NavTraffic® service for GPS navigation systems delivers real-time

traffic information, including accidents and road construction, for

more than 80 North American markets. This communication contains

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements about the benefits of the

business combination transaction involving SIRIUS and XM, including

potential synergies and cost savings and the timing thereof, future

financial and operating results, the combined company's plans,

objectives, expectations and intentions with respect to future

operations, products and services; and other statements identified

by words such as "will likely result," " are expected to,"

"anticipate," "believe," "plan," "estimate," "intend," "will,"

"should," "may," or words of similar meaning. Such forward-looking

statements are based upon the current beliefs and expectations of

SIRIUS' and XM's management and are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are difficult to predict and generally

beyond the control of SIRIUS and XM. Actual results may differ

materially from the results anticipated in these forward-looking

statements. The following factors, among others, could cause actual

results to differ materially from the anticipated results or other

expectations expressed in the forward-looking statement: our

substantial indebtedness; the businesses of SIRIUS and XM may not

be combined successfully, or such combination may take longer, be

more difficult, time-consuming or costly to accomplish than

expected; the useful life of our satellites; our dependence upon

automakers and other third parties; our competitive position versus

other forms of audio and video entertainment; and general economic

conditions. Additional factors that could cause SIRIUS' and XM's

results to differ materially from those described in the

forward-looking statements can be found in SIRIUS' Annual Report on

Form 10-K for the year ended December 31, 2008 and XM's Annual

Report on Form 10-K for the year ended December 31, 2008, which are

filed with the Securities and Exchange Commission (the "SEC") and

available at the SEC's Internet site (http://www.sec.gov/). The

information set forth herein speaks only as of the date hereof, and

SIRIUS and XM disclaim any intention or obligation to update any

forward looking statements as a result of developments occurring

after the date of this communication. E-SIRI Contact Information

for Investors and Financial Media: Investors: William Prip 212 584

5289 Hooper Stevens 212 901 6718 Media: Patrick Reilly 212 901 6646

http://www.newscom.com/cgi-bin/prnh/20080819/NYTU044LOGODATASOURCE:

SIRIUS XM Radio CONTACT: Investors: William Prip, +1-212-584-5289,

, or Hooper Stevens, +1-212-901-6718, ; or Media: Patrick Reilly,

+1-212-901-6646, Web Site: http://www.sirius.com/

Copyright

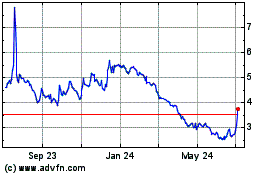

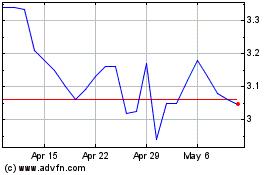

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024